Many Boomers plan to move as part of their retirement strategy, with nearly onethird downsizing, but adult children who are still living at home well into their 20s or even 30s are keeping some parents from making a move or causing them to delay retirement while their "kids" are finished university or otherwise struggling to find their footing on their own.

"If you have adult children living at home, consider asking them to help with the mortgage payments," says Farhaneh Haque, director of mortgage advice with TD Canada Trust. "If they are living with you to save money, their contribution to your household finances would probably still be less than they would pay in rent elsewhere."

Of those Boomers who plan to downsize, 17 per cent are delaying moving to accommodate their adult children who are living at home - or so-called "boomerang kids" - while 12 per cent who are staying in their homes say they're doing so because they plan to have their children living with them after they retire.

Nearly four in 10 (39 per cent) of Boomers who plan to retire in the next three years still have a mortgage on their home, yet two thirds expect to retire mortgagefree (65 per cent).

The report also found that onethird of Boomers who plan to move say the move is part of their retirement strategy, while 41 per cent say they will not require a mortgage to finance their home.

Sixty-eight per cent want to put down as much of a down payment as possible; 44 per cent will try to save on interest by increasing the frequency of mortgage payments; and 34 per cent will try to save on interest with a shorter amortization period.

As Boomers near retirement, it's clear that in one way or another, their adult children are still having a big impact on their retirement plans and real estate purchasing goals.

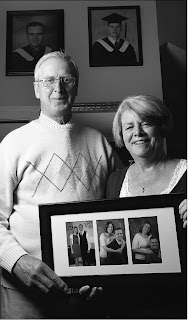

Take Mary and Frank Duffin, who are 64 and 67. Frank continues to work and doesn't foresee retirement any time soon. Their adult children aren't living at home, but they are having a direct influence on where the couple lives.

They recently purchased a new home on the same street as their son and daughter-in-law just to be closer to them as they build their own lives together.

"We're going to be living five doors away from our son and daughter-in-law," says Mary. "I thought: What daughter-in-law would want her mother-in-law down the street, but it's been her encouragement to build on the same street as them."

They've lived in the same house for several years, but don't want to downsize into a condo as they near retirement age. "It's a big step for us to even think of selling our house to do this," Mary says, adding the whole motivation for their recent purchase has been their son.

"Our main partners in life are our kids - all the family," she says. "This is a great opportunity for us to build another home from scratch to be near our (son)."

They're not ready for the seniors' home any time soon and Frank plans to work for many years to come. "There's no way he'll ever be ready for retirement," Mary says, joking.

She looks at the new home as an opportunity to take the next step in their life together. "I don't call it downsizing," Mary says. "I call it rightsizing."

Jessy Bilodeau, a mobile mortgage specialist with TD Canada Trust, says it's clear how much effect the adult children of Boomer parents - whether they're still living at home or not - have on serious financial decisions such as real estate and retirement planning.

"We are seeing parents stepping in to help their kids financially, which of course does affect their retirement goals," Bilodeau says.

"If there are adult children living at home, obviously that might be delaying or affecting the retirement strategies of parents."

It's a trend that has increased in recent years, but one Bilodeau expects to continue. "The cost of education isn't going down, the cost of living hasn't gone down and rent definitely hasn't gone down," she says. "We see most parents are willing to help out their kids in some way."

That help often brings with it some serious financial considerations, though. Even paying an extra $100 a month can substantially reduce your amortization, or the length of time remaining on your mortgage, Bilodeau says.

Aside from increasing your mortgage payment, Boomers may also take advantage of weekly or bi-weekly payments. By making smaller, more frequent payments, you can reduce the interest costs of owning a home and pay off your mortgage faster.

Making lump sum payments when you have extra cash, such as a tax refund, will also help homeowners become mortgage-free sooner. "That could potentially cut years off your mortgage," Bilodeau says.

Adult children will undoubtedly continue to have some effect on Boomer parents and their retirement plans, so just be wise about your choices and build that into your long-term financial strategy.

For the Duffins, the decision to build a new home at a later stage in life was a no-brainer. "We've got a great family and that's what it's all about," Mary says.

Source: http://www.calgaryherald.com/business/Boomers+adult+kids+affect+life+decisions/5740145/story.html

No comments:

Post a Comment